As the shipping world ramps up its efforts to decarbonise, ports are failing to update their master plans to accommodate green fuels for industry and shipping, says Cameron Gook, senior infrastructure economist in port economics and infrastructure for Royal HaskoningDHV

The clock is ticking loudly. Slow-moving ports must act now or risk losing out to their faster-paced competitors.

For both industry and shipping, methanol and ammonia remain the most viable green fuel options. Methanol is in pole position due to its compatibility with existing dual-fuel engines, while ammonia requires dedicated engines still under development.

Both are derived from hydrogen but differ in their environmental impact. Both are carbon neutral if produced using renewable electricity, although green methanol releases CO2 in combustion and therefore requires difficult to source green CO2 in production.

Crucially, ports accommodating these fuels need production and handling infrastructure to meet import and export demand from industry and bunkering infrastructure for shipping. Precious space is required for their footprint, as well as safety zones, which are especially challenging for space-constrained brownfield ports.

Fuel demand, planning and investment

The market for methanol and ammonia as shipping fuels is growing rapidly as more ships are ordered with methanol-ready or retrofitted engines. Ammonia, although limited to a few isolated trials, looks promising. The good news is that both fuels boast established industrial applications with a mature supply chain that can be expanded to meet future demand.

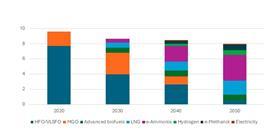

By 2050, it is expected that green ammonia will account for over 40% of the global shipping fuel mix, making it the dominant player. Green methanol will enter the mix by the late 2030s, with its grey, carbon-emitting biofuel counterpart filling the gap before then. By 2050, high-polluting fuels like Heavy Fuel Oil (HFO) and Maritime Gas Oil (MGO) are forecast to be almost entirely phased out, while LNG will continue its steady rise as a low-carbon alternative.

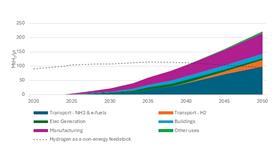

Total hydrogen demand is forecast to grow from 100 million tonnes in 2024 to 320 million tonnes by 2050, according to DNV. Its consumption is expected to shift from predominantly local use to a globally traded commodity. Over half is projected for the transportation sector in the form of pure hydrogen, ammonia, methanol, and other green fuels, while the remainder is earmarked for manufacturing. This demand surge is likely to influence shipping route dynamics due to the scale and speed of the transition.

Determining the right time to invest in green fuel port infrastructure requires an understanding of global market dynamics and a local view of production and consumption. Ultimately, adoption rates will vary by region, influenced by local supply and demand, regulation and carbon reduction targets.

Infrastructure investment timing will differ by region; however, it is advisable to start investment in ammonia handling infrastructure between 2026 and 2030 to ensure market capture. Investment in methanol handling infrastructure is required now to prepare for the rapidly growing number of methanol-powered ships on order and industry demand.

For the best outcome, it’s advisable to engage in the green fuels value chain and form partnerships to ensure trade continuity. Again, many will be regional.

Green corridors connecting green fuel production hubs with consumer regions will unite relevant stakeholders and be fundamental to determining investment timing. A recent partnership between Ulsan Port and Hyundai with investment in fuels at the port illustrates one such effective commercial partnership.

Key considerations for port infrastructure

It is critical that port strategies and masterplans consider green fuels for bunkering, import, export, and onsite production.

1. Spatial allowance

Accommodating a green fuel infrastructure footprint may present a significant challenge. Green fuels require pipelines, pumping stations, processing plants, trucking, bunkering berths, and large storage facilities. Ammonia needs onsite production facilities for ports intending to export the fuel, as transporting it over land is costly due to its temperature and pressure requirements.

Gaseous ammonia pipeline transport is relatively easy through pipelines, but costly cryogenic or pressurised transportation should be minimised. Ammonia production inputs of renewable electricity and water will require pipelines, high-voltage transmission lines and other electrical infrastructure.

2. Safety zones

Safety issues are a significant point of attention, especially the perception of the public. Ammonia is toxic, hydrogen is explosive. Establishing safety standards, capturing the experience that has already been built around these products and around conventional products with similar risk profiles, is key in providing convenience for authorities and public that they are safe. Standards are under development, with the Dutch PGS-12 as a good example, but also ISO and EN are working hard to establish suitable standards.

Ammonia especially has larger affected zones than traditional fuels however with additional protections, safety zones can be comparable with those of traditional fuels. This may be challenging for brownfield ports to implement, so comprehensive impact assessments of possibly affected zones are essential for safely introducing ammonia and other green fuels.

Safety considerations should extend to the entire supply chain, including high-voltage transmission lines and pipelines transporting hazardous materials. While these must be kept separate from populated areas, recent technological improvements and mitigation measures have shrunken safety zones, allowing more flexible infrastructure design.

3. Flexibility and repurposing

Given the rapid changes expected in fuel handling requirements, ports must prioritise flexibility in infrastructure design. Those already possessing fuel handling and bunkering facilities have an advantage, as existing infrastructure may be repurposed for green fuels, albeit with some additional safety measures for ammonia. Repurposing reduces capital costs and minimises risk.

4. A staged approach

A phased development approach will help ports gradually scale their infrastructure as demand increases. Initially, ports may rely on trucks for fuel transportation and storage in ISO containers or floating units. But as demand grows, pipelines and permanent storage facilities must be introduced. A staged and modular approach to capacity minimises upfront costs and allows ports to adapt their infrastructure over time based on actual demand. Meanwhile, pilot projects provide a means to mitigate teething issues, gain experience, and test the viability of handling fuels at scale.

Timing is everything

Ports must plan immediately for green fuels or risk being left behind. To maintain their relevance and competitiveness in a rapidly changing maritime landscape requires detailed end-to-end planning.

Ports must understand the regional variations in play and engage early and continuously to ensure they acquire the resources and partnerships needed for large-scale infrastructure projects. This means looking beyond traditional stakeholders and collaborating with renewable energy developers, water authorities, and grid operators. If they don’t do all this, their competitors surely will.

The regional context is critical here. Understanding the market maturity and dynamics and actively engaging with the stakeholders in the value chain i.e. Government, industry consumers and producers, will enable ports to identify the best route to take in terms of investment.

For many smaller ports, bunkering of green fuels will not be financially viable as they will not be able to compete with their larger counterparts within the region, however, they may find that industry in their hinterland is demanding a green fuel and an investment opportunity exists to facilitate the supply.

To limit the initial capital investment, ports can use various strategies such as an investing in storage infrastructure and using trucks for transport to and from ships and industry rather than investing in expensive pipelines. As demand ramps up storage can be scaled and pipelines installed to increase capacity.

Small ports may also benefit from cooperation with other ports. To create a multifuel green corridor for instance, not every port along the route needs to be able to provide all fuels. Coordination then allows ports to specialise, reducing capital investments and risks.

For all ports, big and small, scalable solutions are necessary, which are able to follow the market trends balancing appropriate investments with envisaged revenues.

Port planning in action

Port of Den Helder H2 feasibility study

The North Holland (province) North region has an ambition to further develop and roll out the hydrogen economy in the region.

A preliminary study investigated the feasibility of a bunker facility for liquid hydrogen placed in the Port of Den Helder, Holland’s most northern situated port.

Royal HaskoningDHV identified the opportunities for bunkering of liquid hydrogen in coastal and offshore vessels and ferries, based on stakeholder analysis and market demand analysis.

The team carried out the market assessment and advised the customer on the feasibility of hydrogen bunkering and the business case for the port. It estimated the market potential for a liquid hydrogen bunkering facility on the basis of an assessment of marine traffic movements, ship types and a sector analysis of relevant offshore markets.

Port of Rotterdam ammonia study

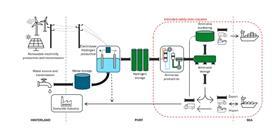

A study executed by Royal Haskoning DHV, commissioned by Port of Rotterdam Authority (PoR) has looked into the feasibility of ammonia transport to the hinterland via inland navigation, rail and road.

This study supports the Port’s vision of becoming a hydrogen hub by 2050, with ammonia as a key hydrogen carrier. It examines the current and projected transport capacity, market demand, and the social and environmental impact of large-scale ammonia transport.

The study identifies transport gaps, particularly for inland shipping, and explores the potential for scaling up capacity. Recommendations include infrastructure improvements, long-term contracts, regulatory clarity and social engagement to ensure safe and sustainable transport.